Penny-pinching is looked down upon in society, but so is living pay cheque to pay cheque. Which side do you want to be on?

If you want peace of mind knowing that your savings will cover your expenses for the next couple of years, you would not mind stretching every dollar, making strict need-based purchases, and growing your savings in a tax-friendly environment.

Are you saddled with credit card debt or monthly car repayments? Do you feel like quitting your job but do not have the financial cushion? Whatever be your situation, penny-pinching around the house can help you pay off your debt sooner and save up for a rainy day as well.

If you do not know where to start, this article is for you.

Declutter your home

Do you see stuff lying around the house that you have not used in the last six months? If so, it is time to declutter. You can make money by selling your unwanted items online. A China set or the exercise equipment that only serves as a clothes hanger; you can list your items online or set up a yard sale with lemonade and cookies on the house.

Avoid tumble drying

Always choose a sunny day to wash your clothes so that you can hang them on the clothesline without having to put them in the dryer. Repeated tumble drying can also damage your clothes over time, so it is better to avoid tumble drying, not only to reduce utility bills but also to make your clothes last longer.

Compare electricity and gas prices

You might be paying more in energy bills than you should. If you have been using the same energy provider for years, it is time to research and compare the gas and electricity prices in your area. You will be surprised to see what other energy providers are charging and how much money you can save by making a switch.

Avoid food wastage

Food wastage is common in a household, especially when you have kids. Wasting 20% of your food five times over is equivalent to wasting a whole meal. If you prepare three meals a day, you are throwing away a whole meal every second day. As a decision-maker of the house, it is important to put your foot down and make strict rules around food wastage.

Avoid bottled water

Carrying your water bottle to the grocery store, shopping mall, or a nearby restaurant can save you $4 per litre. In case you did not know, bottled water can cost up to 2900 times more than tap water. You will be shocked to see how much you can save in just three months by avoiding bottled water.

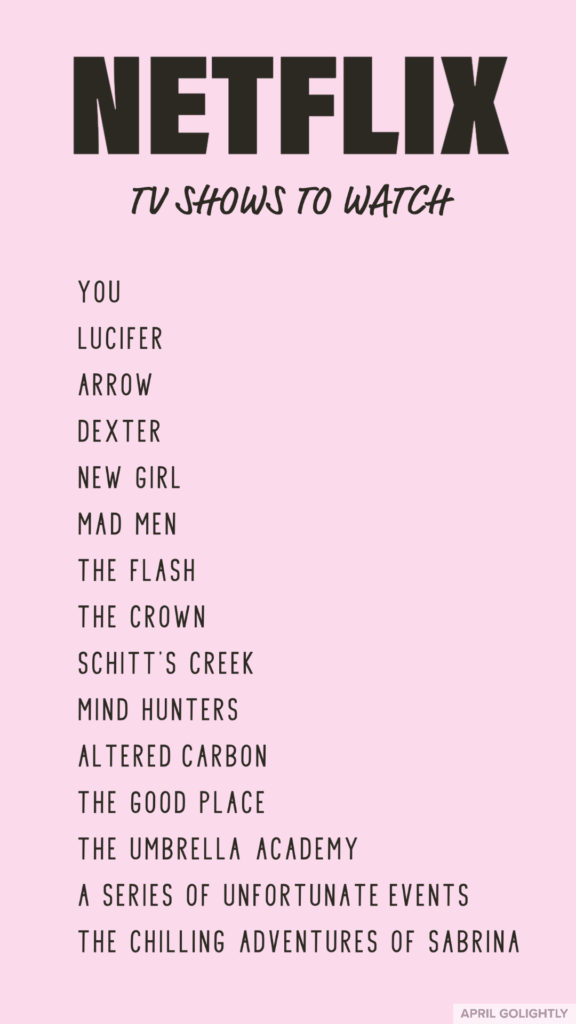

Cut down on home entertainment cost

In today’s day and age, where entertainment platforms are cheap and full of quality content, paying for cable TV does not make sense. In Australia, a cable TV subscription can set you back by $100 per month, whereas a Netflix subscription is a mere $10.99. Furthermore, you have free access to YouTube and other streaming platforms that deliver great entertainment right to your smartphone or any other smart device.

Given the volatile nature of jobs and markets, it is not easy to navigate economic uncertainties and achieve financial freedom; however, taking one step at a time and staying consistent is key. It starts with saving money – at least 10% of what you earn – then you will be well on your way to living debt-free.

Great article! Thanks for sharing with us!

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?