This post was sponsored by Chime as part of an Activation for Influence Central. I received complimentary products to facilitate my review.

Spending money is probably the easiest thing I do every day. I can sit at my computer and spend lots of money on cute shoes and bags. Before writing this, I almost bought a pair of heels that I’ve had my eye on for quite some time. Let’s face it. Setting aside money for savings is easier said than done.

Brunch with friends, cute shoes, and your kids Back to School purchasing list, on top of the monthly mortgage or rent and monthly bills for most of us spending money comes extremely easy. Saving does not come as naturally to most of us. My old bank made saving money a nightmare. They were charging me for everything under the sun and I wasn’t saving anything. I hate to admit it, but it is the truth.

Get Closer to Your Money

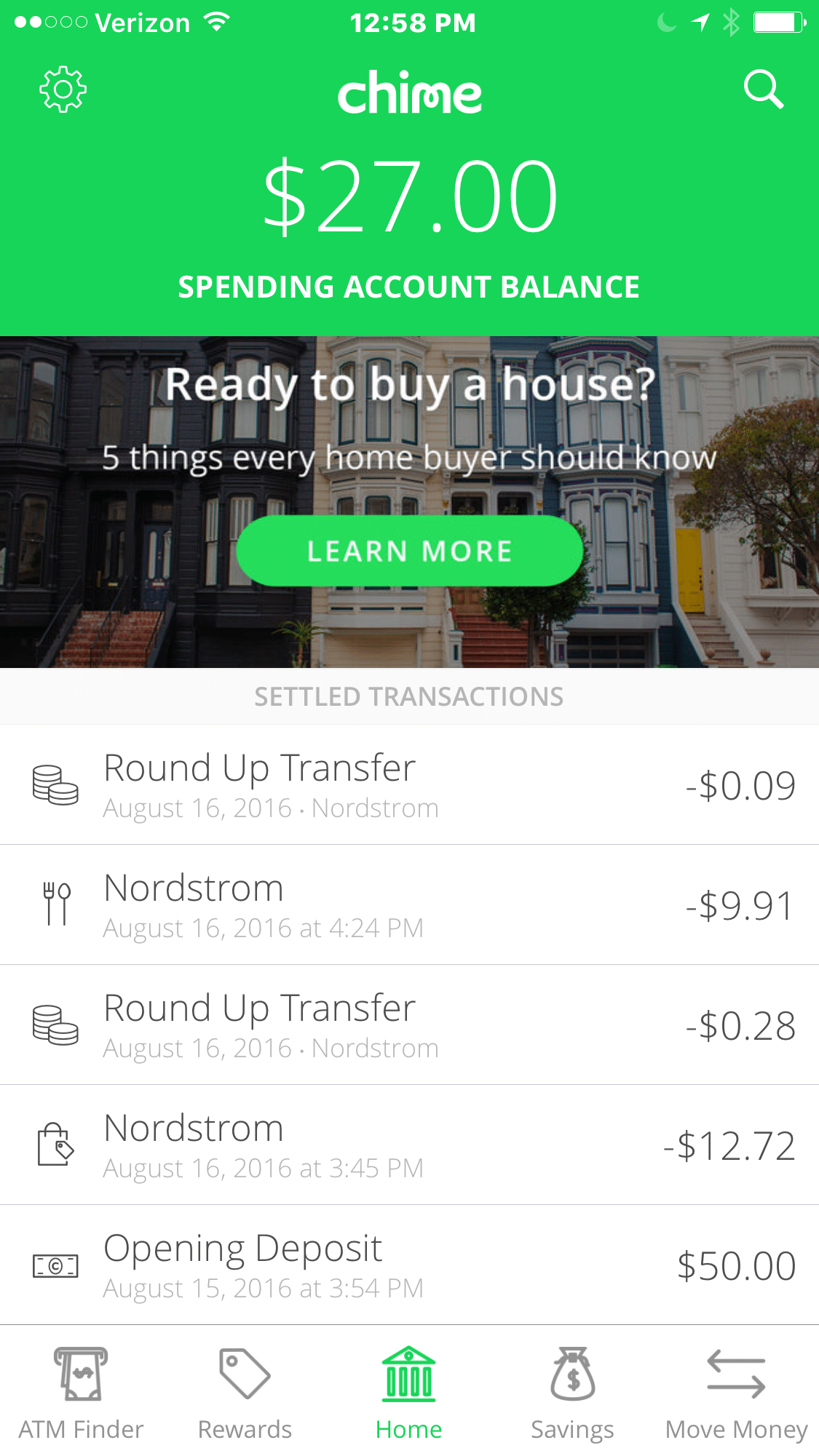

The best way to start saving money each week is to get closer to your money. If you have an app that lets you know when any payments are made, you can keep an eye on your money and savings. When I know what I have in the bank, I feel like I have my finger on the pulse on the money. For a long time, the money was in a bank account that I rarely looked at. You can also look at where you are spending money, when you have immediate access. Do you spend way too much money when you go to stores like Target and Walmart? Why not order things online so that you don’t get side tracked by a cute aisle filled with things you don’t need.

When looking at the money you are spending, have in the back of your mind that if you can save it, that will allow you to retire sooner, rather than later. A lot of people ask can I retire with $5 million? Will your savings allow you to get to this number one day? Or are you going to have to make some changes so you can

Avoid Unnecessary Fees

I do not like any fees related to banking. Having taken a lot of finance and economic classes, I know that banks make money from holding your money. We should not be paying fees to let banks lend our money out to borrowers.

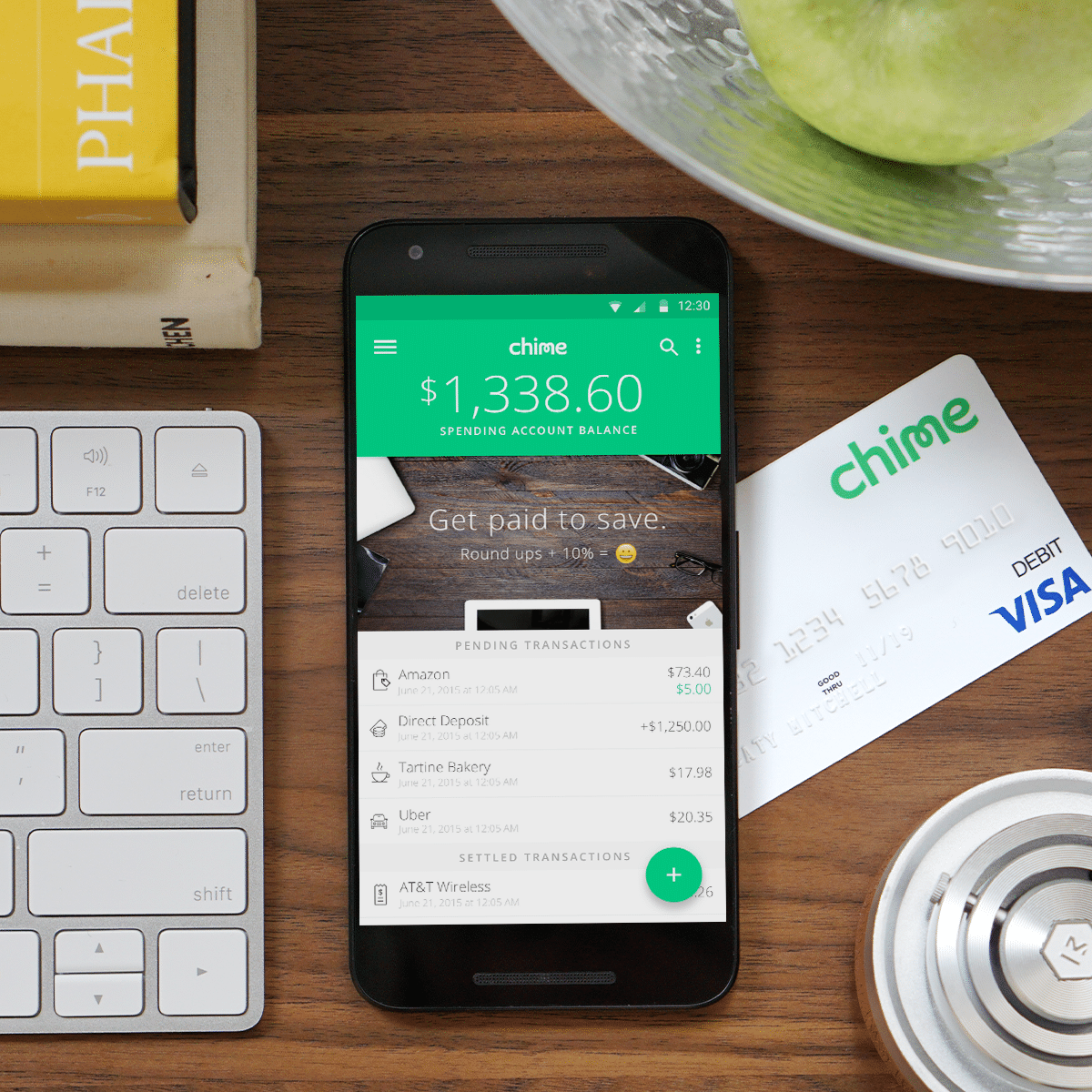

When you bank with Chime, there are no monthly fees or minimums, no overdrafts and ATMs are fee free at 24,000+ locations.

Automatic Savings

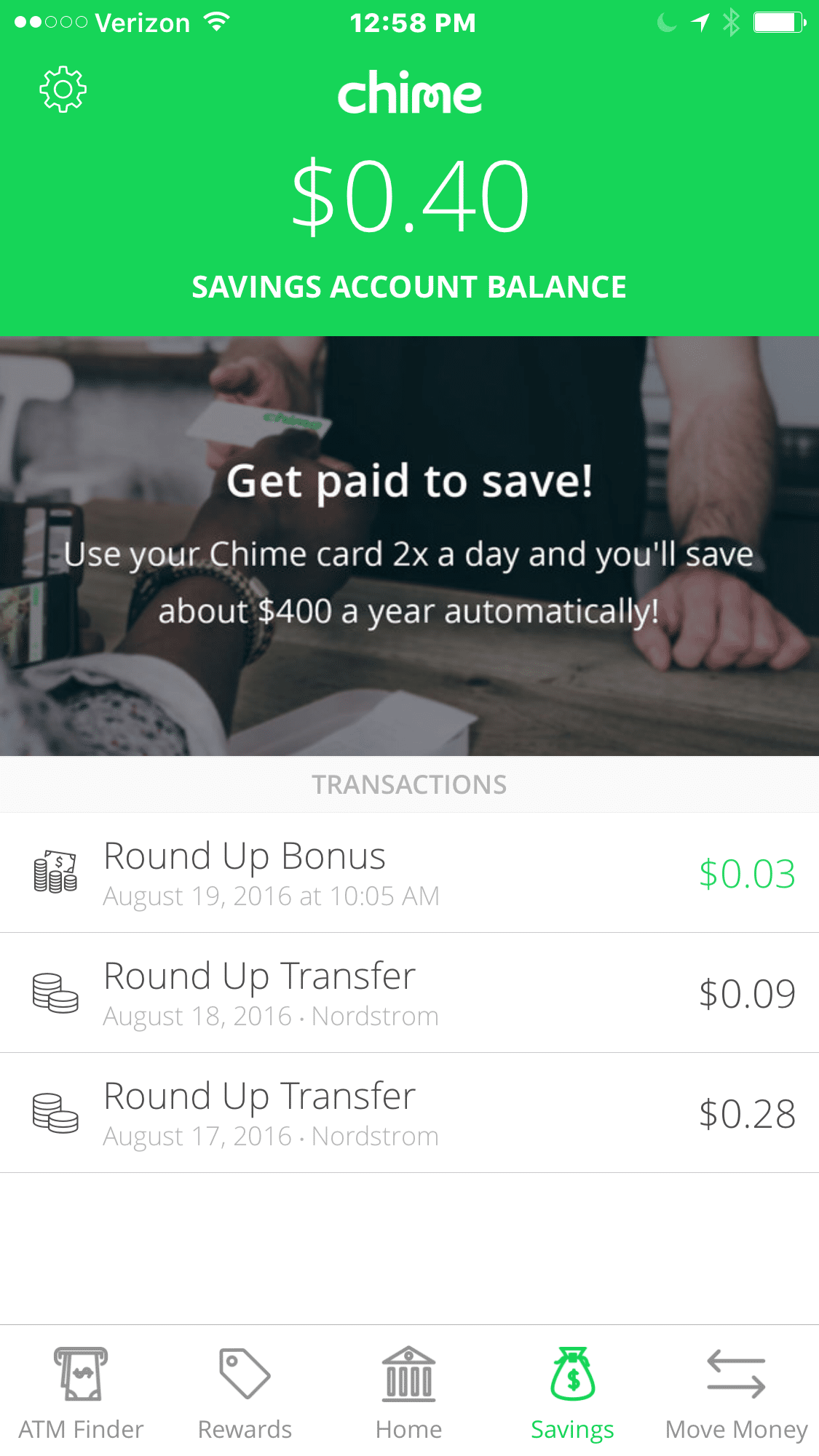

You can enroll in automatic savings on the Chime spending account. When you enroll in Automatic Savings, each time you use your Chime card to pay a bill or make a purchase we round the transaction amount to the nearest dollar and transfer it from your spending account to your savings account. Then, every Friday they pay a 10% bonus on your round ups for the week. If you use your Chime card twice a day on average, you’ll save about $400 a year without even thinking about it.

I love using the Chime card straight from my phone in the Passbook on my iPhone. It has helped me save money each week.

Follow Chime on your favorite social media: Facebook; Twitter @chime; and Instagram @chime